Last night I chatted with a market expert who’d been spending plenty of time in recent weeks talking with senior staff from a mid-market, mid-Western US investment bank i.e a very mainstream American investment institution. By nature, most of the bank’s principals were fairly cautious individuals which coincided nicely with the views of many the bank’s clients who were equally cautious by nature. Many were sitting on big piles of cash, waiting for the next big crash – prime examples of the Wall of Worry argument. Yet this caution was deeply unprofitable in portfolio terms and the bank didn’t feel that there were any obvious reasons for a big sell-off: profits were surging, the US economy was doing just fine, taxes were about to be cut, and valuations were becoming more reasonable.

Overall, I’d say this is typical of a cognitive dissonance which afflicts a great many investors. Their guts suggest caution whilst their investment logic screams that valuations are stretched. yet markets keep ignoring these concerns, presenting plenty of contrary evidence to suggest that equities are the best of a bunch of bad options. One additional small example of this dissonance – Numis has just reported that sales of open-ended bond funds have hit record levels. In a rising rates environment where equities are providing very solid, low volatility returns, bonds are quite possibly the worst investment choice imaginable. And yet investors keep on piling money into these big black holes.

By and large, I have sympathy for this rampant investor caution, for the Wall of Worry argument. Yet I’m also virtually fully invested and perfectly happy to seize opportunities when they arise. I’m not heavily invested in US equities but I also think there are some fascinating businesses out there, clearly making abnormal profits. I ring up my broker every once in a while to ask about downside protection via a hedge, but I then do absolutely nothing about the subsequent advice. I am a walking, talking example of this cognitive dissonance.

Maybe though my actions are speaking louder than my words, telling a different story. Isn’t the logical strategy at the moment, to be very bullish and long risky assets? Shouldn’t investor’s ignore their wall of worry and embrace a difficult though rewarding truth – that we are only midway through a long 10 to 15 year bull market in equities.

Three charts from a new manager Arbrook here in the UK tells this story well. This is a new very actively managed open-ended fund structure looking to raise about £100m over the next few weeks. I’ll return to the fund (and its excellent manager) at a later date but for now, I want to simply show three charts from their investment presentation which I think hint at this fascinating, bullish alternative universe. In sum the message is that we should all stay invested for what is only just the start of a long bull cycle – in this alternative vision, there’s even better news to come, especially in the US equity markets. So, to our three charts……

The first chart maps out the first few paragraphs of this blog – the wall of worry versus the S&P 500. It shows how the wall of worry has been constantly overcome by US equity momentum – how the bearish pundits have been consistently wrong and how the S&P 500 has powered ahead since 2010.

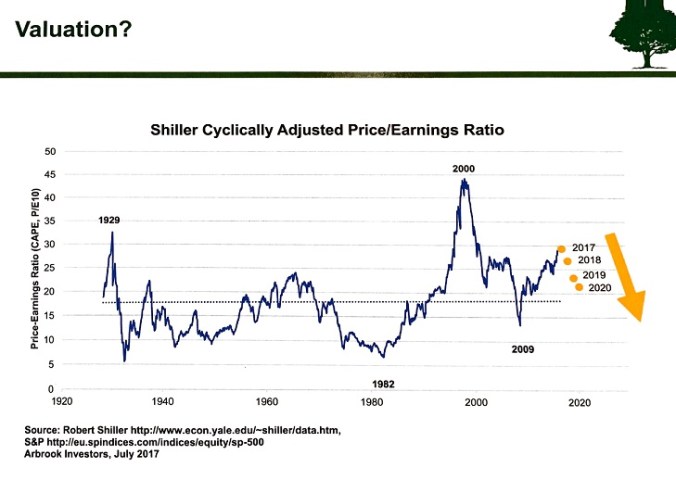

The next chart looks at valuations through the prism of the Shiller CAPE index. Sure, according to the CAPE measure valuations do look well above average, especially when compared to the last one hundred years but once we rebase the index around the period since the 1990s, the current measure doesn’t look in the slightest bit extreme. Why rebase? Because something very important has happened to profits, corporate structures and technology over the last few decades – earnings are surging even as wage rates stagnate. Arguably globalisation and new technological advances, combined with increasing levels of oligopoly control, are helping to permanently rebase corporate profits to higher levels. And as those corporate profits surge, helped along by lower taxes, we could see price to earnings ratios move back to more reasonable levels by the beginning of the next decade.

The last chart from Arbrook is perhaps the most incendiary. It looks at a variety of S&P 500 market cycles, with those marked in green representing a momentum driven breakout while those marked in orange represent sideways and declining markets. Since the end of the global financial crisis, we’ve clearly moved into a momentum-driven breakout phase, with lots of structural factors underpinning buoyant investor spirits (not least technological change). Yet most breakouts last a great many years whilst our current cycle is very immature at just a few years in duration. If we are poised for the mother of all bull markets we could see the current market hit new highs for at least another two to three years – before the inevitable retreat sometime early in the next decade.

I have to say that I’m not entirely convinced by the argument that we could have at least another three to four years of surging share prices, but I’m not entirely dismissive of this argument either – as I once was! I genuinely think that something of a deeply structural nature is happening, powered by technology and globalisation – and it is providing a permanent boost to corporates. Perhaps the simplest explanation is the best – the most dominant structural factor are low-interest rates, which help to boost the share prices of valuable, income producing assets such as corporates. And as my core view is that low-interest rates are here to stay, maybe this key structural tailwind will remain the dominant one for at least another 5 to 10 years? In which case, make sure you are long equities and ignore all those moaning pundits and value fiends telling you to stay in cash!

I’m sure there a million and one reasons why these bullish arguments could be wrong, not least because of worries about valuations and the rise of populism. But I think we investors need to be careful of our pervasive caution and the growing evidence of cognitive dissonance – we may be constantly looking out for a massive sell-off, but then myopically miss the mother of all momentum-driven bull markets!

Leave a Reply