The idea that any of us should be worrying about inflation still seems slightly laughable in Europe. As Albert Edwards from SocGen pointed out last week, Eurozone CPI fell to only 0.2% yoy in September “from an already shockingly low 0.4% in August takes us another giant step towards outright deflation – which we can loosely define as core CPI inflation falling below zero (most economists would recognise that to be a reasonable definition).”

But what happens in the Eurozone is not necessarily a guide as to what might happen in the Anglo Saxon world. Analysts at DWS for instance remind us that for the first time since 1995, U.S. durable consumer-goods prices are rising! The recent Personal Consumption Expenditures (PCE) Price Index for August turned positive, having previously sunk deep into dis-inflationary territory. Prices for household appliances (gained 10% since February 2020) and used motor vehicles (gained 17%) were the main drivers.

Short term supply drivers powered by the pandemic are the obvious driver here, and obviously these trends could reverse – as Christian Scherrmann, U.S. economist at DWS, suggests: “The recent increase in durable consumer prices might well prove transitory but it serves as an example of how quickly inflation can react to fast changing circumstances.” Not to overstate matters, durable consumer goods still only account for roughly 12% of overall spending, compared to 66% on services. That said, services prices already trended somewhat above 2% for the past years. Once the fight against the virus is won, the odds are that services will likely face capacity shortages too.”

Back in the dizzy, giddy world of equity markets, options investors seem to be getting less nervous – or at least according to one measure used by Deutsche Bank’s regular Investor Positioning and Flows report out today.

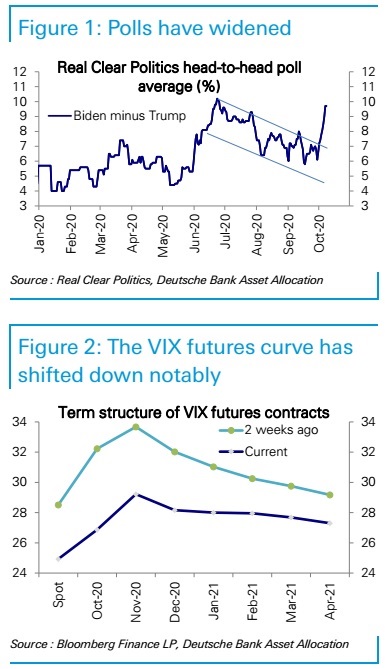

The clue is in the Vix futures curve below.

According to the Deutsche report “two weeks ago, we noted that with polls tightening gradually, a consensus had been growing for extended volatility in the run-up to and especially after the US election. The slope of the VIX futures curve, which has been closely and inversely correlated with election polling gaps, had in turn steepened significantly. Over the last two weeks however, Biden’s lead over Trump in recent polls has widened notably, and in response, the VIX curve has fallen. As we have argued previously, widening polls cause election risk premiums to decline and in turn see equities rally while tightening polls, a selloff, regardless of who leads.”

The Deutsche analysts are, rightly in my view, cautious about US election complacency identifying a number of possible risk factors:

- Polls in key battle ground states remain tight

- Approval ratings still point to a close election

- The key risks to getting a quick and clear resolution after the election remain significant

I’d absolutely echo that third point. Almost regardless of who wins, we should expect a VERY BUMPY November! Unless Biden (or Trump?) wins by a really wide margin (please dear god), I can absolutely foresee extreme street level protest. Both sides have, foolishly in my view, talked themselves into extreme positions. As we have seen, all it takes is for a few people to start shooting each other – the latest seemed to involve a TV unit security guard shooting a right-wing protestor – for the keg to blow.

One last point on international diversification. US investors already seem to be hedging their bets and diverting cash to overseas markets. According to the Deutsche report “since mid-June, there has also been a clear rotation in flows away from US equity funds, which have seen strong outflows (-$42bn), while the rest of the world has seen inflows (+$51bn), a reversal of the trend that prevailed earlier since March. The divergence since June has been marked by outflows from secular growth funds in the US even as those in the rest of the world have enjoyed a continued surge of inflows; ESG fund inflows into the US lagging those elsewhere; and continued outflows from cyclically oriented US funds even as those elsewhere have eased”.

Leave a Reply