Two interesting research snippets caught my eye last week.

The first is from Bath-based risk consulting firm CheckRisk. They’ve just issued an alert on Commerzbank. They call it a distance to distress alert and the big German bank is now in the red sector of their model.

Here’s CheckRisk:

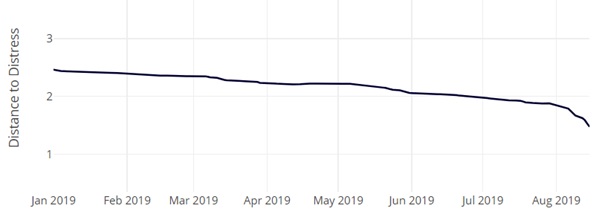

“It is the first time we have seen two systemically important banks in Germany having an alert attached to them since the 2008 crisis. Although we have seen this kind of pattern occur in the past in other EU zone countries such as Italy, Greece, Spain and Portugal. We are also seeing stress connectivity in the Turkish Banking System. How severe is the level of distress at Commerzbank? The year to date plot shows that bank has been drifting towards distress throughout 2019, having started the year in a relatively healthy position. The distance-to-distress has fallen from around 2.5 at the start of the year to 1.47 today. Over the year the equivalent odds of the bank experiencing distress on a daily basis have been reduced by a factor of three from about 1 in 12000 in January to about 1 in 3900 today, meaning entering distress is three times as likely. To add context, Deutsche Banks distance-to-distress was at similar levels just before it announced it’s restructuring on July 7th 2019. Banks that fall below 1.5 Dtd have a tendency to continue to deteriorate as other market players begin to review and withdraw credit lines to the troubled party. The recent decline in Commerzbank’s Dtd is precipitous and noteworthy”.

One reason why Commerzbank might be having challenges is that German exports have been hit badly by the US/China trade dispute. On this subject emerging markets bank Renaissance Capital issued a report last week called “Who’s afraid of the big bad trade war”.

They broke the current trade spat down into four stages, as in the chart below

- Normalization: The six months running up until 22 March 2018, when President Donald Trump signed a memorandum to file a WTO case against China for discriminatory licensing practices, restricting Chinese investment into the key technology sector and imposing tariffs on $60bn of Chinese imports.

- Escalation: The period from 22 March 2018 until 1 November 2018, when Trump and President Xi Jinping held a phone call paving the way to the 1 December 2018 trade truce announced at the G20 summit in Buenos Aires.

- Normalization: The period from 1 December 2018 until 5 May 2019, when Trump tweeted that the Chinese were “attempting” to renegotiate the trade deal and backsliding on commitments, and that he planned to increase existing tariffs and widen tariffs to cover essentially all of China’s imports.

- Escalation: The period from 5 May 2019 to now.

The bank’s analysts then looked at which sectors and geographies were hit hardest by the varying phases of the dispute.

- Most strongly sensitive to trade war escalation: EM (vs MSCI World), EM Asia, BRIC, China and South Africa. Estonia, Kenya and Vietnam in FM. IT among EM sectors.

- Most strongly defensive to trade war escalation: LatAm, Taiwan, Brazil, Colombia, Poland and UAE. Lithuania and Morocco in FM.

- More sensitive than not to trade war escalation: Korea and Saudi Arabia. Consumer discretionary, healthcare, financials and real estate among EM sectors.

- More defensive than not to trade war escalation: India, Indonesia, Malaysia, Philippines, Thailand, Argentina, Chile, Mexico, Peru, Czech, Egypt, Greece, Hungary, Russia, Turkey and Qatar. Bahrain, Bangladesh, Bulgaria, Croatia, Kazakhstan, Kuwait, Lebanon, Mauritius, Nigeria, Oman, Romania, Sri Lanka, Serbia, Tunisia and Ukraine in FM. Materials among EM sectors.

- With no obvious pattern of performance: EMEA, Pakistan, FM (vs MSCI EM). Jordan and Slovenia in FM. Energy, industrials, consumer staples, telecoms and utilities among EM sectors.

Leave a Reply