Quick reminder – do come along to the Digital Wealth Forum on Tuesday, Oct 2nd. Details here (tickets free). And don’t forget to sign my Trust the Investor petition, HERE

It’s easy to see why absolute returns funds have become so insanely popular in recent years. We’ve seen a necessary move towards solutions based investing, and who wouldn’t want the solution on offer from absolute returns managers – positive returns in all markets. The problem of course with all grand promises is that they usually fail to deliver. Academics have rightly taught us to be careful about the claims made by active managers, which is why the extravagant claims made by absolute returns specialists need to be treated with Hazchem gloves.

Last week Tempo Structured Products released the latest research into absolute returns – with fairly damning conclusions. Now obviously one must emphasise the caveat – Tempo offers a rival product to the popular absolute returns fund, the structured product. These don’t make quite the same claim as absolute returns – their USP is contractual, defined returns in most markets. They’ll get hammered in a massive market sell-off, but in most other markets they’ll usually do what they see on the tin – or on the investment contract!

So with that caveat out of the way, it’s time to dig a little deeper into the report – its called Targeted Absolute Returns Funds: Mind the Gap, and its the first of a series of Debating Chamber Papers by Tempo. Again for full disclosure – I’ll almost certainly be doing a later paper. The Absolute Returns paper is written by Graham Bentley of gbi2 and Chris Taylor of Tempo Structured Products.

It won’t come as a great surprise to professional cynics that most of the claims to absolute returns investing are disproved in the paper.

Let’s first itemise what most of us probably want from an absolute returns fund. I’d suggest:

- positive returns in all markets, year in year out. In the absence of that…most years!

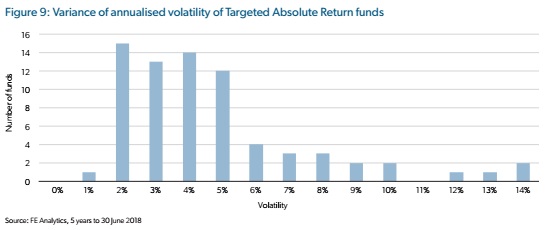

- reduced market volatility

- Actual positive returns and preferably more than on offer from cash (or gilts)

- Not charged too much for the privilege of all this clever active management

- Lastly, call me old fashioned but I’d quite like to understand what’s going on inside the black box.

So, let’s look at some of these ‘aims’ listed above. The first result comes in the table below which compares absolute returns funds as a group with other sectors – all over five years.

According to the report ” the immediate observation to draw attention to is that over the past five years, 15% of Targeted Absolute Return funds have produced negative returns. Over three years, the percentage is higher still: 30% have failed to produce a positive return”. The good news is that as one might expect, the median return for the Targeted Absolute Return funds “is the lowest of the sectors shown. But more surprisingly, so is the performance of the worst fund. In other words, investing in a plain old multi-asset Mixed Investment fund would have been a safer choice – with hindsight. And, in fact, none of the Mixed Investment 0-35% or 20%-60% funds produced negative returns”.

So which funds have been producing bumper positive returns? According to the report “over the past five years, to 30 June 2018, the best performing fund was City Financial Absolute Equity, returning 54.17%, or a little over 9% p.a. compound. Closer inspection reveals that over the period the fund also had the highest volatility in the sector and exhibited wildly diverse returns, between 36% and -17% over rolling one-year periods, twelve of which were negative. This investment journey is not exactly ‘positive returns in all market conditions’”. Quite.

The next chart looks a bit more closely at rolling period over the last five years – 49 monthly rolling one year periods – to see what proportion of those periods resulted in: a) positive returns and b) returns in excess of the benchmark. Of 73 funds with 49 rolling one-year performance period histories. The results?

● “Only 2 funds produced positive returns in every period. On average, funds produced a positive return in less than 50% of the rolling one-year periods. [my emphasis]

● On average, funds exceeded their positive return objective in around 49% of periods, and their benchmarks in 41% of the periods.”

One last crucial statistic. I imagine that investors would be mightily unhappy if they discovered that their absolute returns fund turned into an Absolute Negative Returns Fund – the presumption is that all funds are Absolute (Positive) Returns funds. Again according to the report ” despite the promise and the allure of the sector, every fund in the sector suffered a loss as its worst-case maximum drawdown. In fact, Newton Real Return, the third biggest fund in the sector currently, would have lost investors nearly half their capital had they elected to sell at one point during the financial crisis of 2007-2009.”

The only half decent news is about costs. Long gone are the days when active fund managers in this space got away with 2% or more management fees. By and large, the big funds charge much less than 1% per annum as an annual management charge – with most clustering around 0.85% per annum. Now the bad news – performance fees. The report observes that ” the majority of the sector’s investment managers charging performance fees claw back 20% of the performance, with a number of them not specifying a percentage hurdle that they need to achieve, or a

benchmark to exceed”.

I will leave readers to make their own minds up but all I;d say is that whenever my relatives ask whether they should invest their cautious money in an absolute returns fund I suggest they either go the whole hog and work with a hedge fund manager like Brevan Howard (the BH investment trusts spring to mind) or simply stick with cash or possibly gilts.

You can find out more about Tempo via their website HERE – https://tempo-sp.com

If you want a full copy of the paper email me.

Leave a Reply