One of the most interesting developments within global investing over the last few decades has been the inexorable rise of emerging markets. This growth orientated asset class has come from virtually nowhere in the 1980s to become a major focus for many investors.

But this relentless increase in prominence has masked another fascinating trend which is that more and more emerging market businesses are actually becoming relatively mature. That has meant that many businesses within the emerging markets are happy to pay out a dividend to their shareholders. This has profound implications – academic studies have told us that over the very long term, equity investors have received the highest returns from a value strategy, which in practice means focusing on cheaper stocks that have a higher propensity to pay dividends.

Emerging markets by contrast have been typified as ‘growth stocks’ i.e shares in businesses where markets perceive that profits growth will be strong, resulting in strong positive momentum in the shares. Growth based strategies can and do outperform value strategies in some years, especially bullish ones, but over the long term investors inevitably end up over paying for the promise of growth tomorrow !

This simplistic way of looking at investing styles would have traditionally suggested that patient, long term capital investors should steer clear of emerging markets. But if the percentage of dividend paying businesses is rising, maybe we need to think again?

According to a report a few years back by Aye Soe, Senior Director, Global Research and Design at S&P Dow Jones Indices, over the past 16 years the percentage of companies paying dividends has increased at a faster rate in emerging markets than in developed markets. S&P reckons that the percentage of dividend-paying companies in developed markets varies between 60% and 70% yet for emerging markets, while the percentage of companies paying dividends has steadily increased from 60% in 1998 to 70% – 80% in 2014, surpassing the levels observed in developed markets. According to Soe from S&P, the Czech Republic, Poland and South Africa have made the biggest impact in terms of dividend growth. The aggregate annual dividend payout ratio has been climbing steadily in EMs although the S&P analysts also point out that “the dividend payout ratio, which indicates the percentage of earnings that is being returned to shareholders, has been declining in developed markets.

Percentage of Dividend-Paying Companies in Developed and Emerging Markets

Crucially investors who’d put money to work in emerging markets stocks would have discovered that dividend payers in EMs have outperformed non-payers, with much lower volatility.

The S&P research argues that “numerous academic studies have shown that dividend payers have historically outperformed non-dividend payers. However, much of the available dividend research focuses on the U.S. and other developed markets. A study published by Morgan Stanley Research showed that there is a strong relationship between dividend yield and total return in developed and emerging markets, with this link being the strongest in emerging markets. Our analysis of emerging markets shows that, on average and similar to developed markets, dividend payers earn higher risk-adjusted returns than non-payers. If stocks are sorted into quintiles based on yield with the highest yielding stocks in the first quintile, the best relative 12-month performance in the U.S., Europe, and Japan often comes from stocks in Quintile 2, while the best relative performance in emerging markets comes from stocks in Quintile 1.”

Cumulative Performance of Emerging Markets Dividend Payers Versus Non-Payers

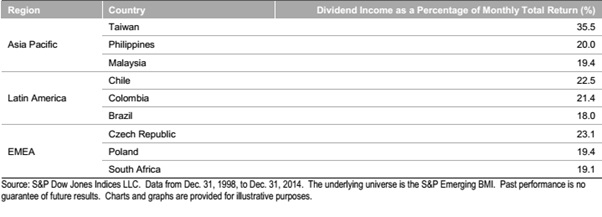

Crucially the S&P study looks at dividend contributions region by region. It discovers that the “dividend contribution from the Latin American region represented 19% of the emerging markets at the end of 2014, decreasing significantly from 35% at year-end 1998. In contrast, dividend contributions from both the Asia Pacific and Europe, Middle East, and Africa (EMEA) regions increased a bit and represented roughly 35% and 46%, respectively, of overall emerging market countries’ dividend contributions at the end of 2014”.

Average Dividend Income in Emerging Markets

This last finding is an absolutely crucial one – it suggests that dividend payers within the emerging world show huge variation between countries, with Taiwan, Chile and the Czech Republic boasting a much stronger dividend culture. This hints at an important truth for this observer which is that a high dividend yield is not always a good thing – what matters is whether the dividend yield comes from a low share price or a local commitment to pay dividends. This distinction is important as unloved sectors/nations/asset classes can sometimes boast a high dividend yield simply by virtue of having experienced a big sell off in the price of the shares.

One last crucial observation – many emerging market dividend ETFs have significantly underperformed their actively managed peers in recent years. This weakness can almost always be accounted for by investing in the wrong kinds of businesses, in the wrong countries! Successful active managers within the emerging markets space have usually made a conscious decision to avoid countries where the corporate governance culture is poor and returns not very visible – ETFs with their focus on quantitative measures built into an index have by contrast found themselves over-invested in some of the wrong nations.

My bottom line ? Investors within the broad emerging markets space need to increasingly focus on dividend yield as a key indicator for picking the right national ETFs. Look at the businesses and sectors the local market features prominently, understand the yield, and see how it has been growing over time. In particular seek out those countries where corporate governance is strong, respect for dividends/external investors widely publicised and the dividend payout robust and increasing over time

Leave a Reply