Investment newsletter Variant Perception has a blog on what I think is the most counter intuitive subject in investment – the long and winding road to ever higher house prices. The conventional wisdom in the US and the UK is that residential housing is insanely expensive and that at some point it must revert to the mean. As I have noted in various Citywire columns I’m very far from being a housing bear and although I think house prices ARE obscene, I also don’t think they are likely to fall fast (except in China, more on that). As long as we continue to a) keep interest rates low and B) restrict supply in the UK, prices will go ever higher. We maybe won’t see double digit growth but it’ll still be strong.

VP thinks the same is true for the US as well. They remind readers that the 2010s

“….marked a lost decade for US homebuilding. The number of homebuilders declined 50% between 2007 and 2012 in the US, and the GFC caused a massive hole in personal savings and equity, meaning that fewer people could afford a home. This drove a shift towards renting and away from owning across all age groups. The supply-demand mismatch is greatest for entry-level single family housing.”

“Household formation drives demand for housing. Millennials are aging into prime home buying age, so the 30-44 age cohort should see the greatest population growth over the next 5 years. Young adults that were living with their parents are now starting to move out.”

Cue even higher prices, even in the US. For the record I am long Green Brick Partners, a second-tier player in the US housebuilders market.

Economist and NYT commentator Paul Krugman last week ran another one of his ‘will China stumble’ columns. He’s been predicting problems for ages but he thinks a la Evergrande we might finally have arrived.

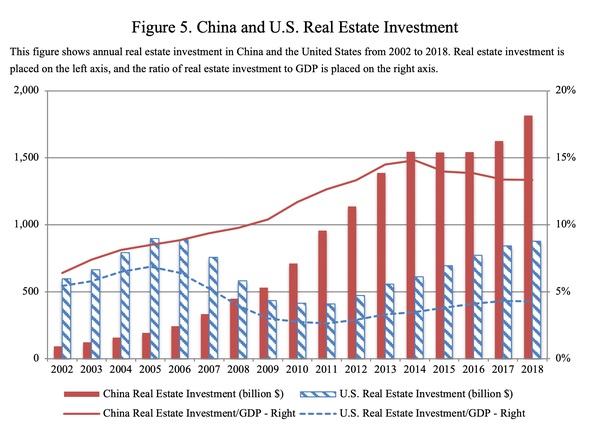

He cites A 2020 paper by Kenneth Rogoff and Yuanchen Yang that shows that Chinese investment in real estate now greatly exceeds U.S. levels at the height of the 2000s housing bubble, both in dollar terms and as a share of G.D.P.:

“Rogoff and Yang also show both that housing prices in China are extremely high relative to incomes and that the real estate sector has become an incredibly large share of China’s economy. None of this looks sustainable, which is why many observers worry that the debt problems of the giant property developer Evergrande are just the leading edge of a broader economic crisis.”

We’ll finish with food prices. Economic historian and commentator Adam Tooze has a fantastic chart below on his Substack that is worth a closer look. The background is higher food price inflation. This is undoubtedly a challenge for many poor countries but I’ve been a tad sceptical myself that we are about to head back in to 1970s stagflationary territory. The numbers just don’t seem to add up.

Which is also what Tooze suspects, though he’s not entirely sure how the numbers pan out. The OECD-FAO graph below shows the price of soybeans, wheat, maize, beef and pork separately. Together they make up a substantial part of the FAO food price index and according to the OECD-FAO calculations, in real terms they are up slightly relative to 2020, but they remain very far below their 1970s peaks.

Tooze has bene trying to reconcile this long term data with short term staple food price inflation – to no avail so far. But I think he’s spot on when he warns about taking too much of the 1970s Redux Stagflation argument at face value.

“ Right now, amidst all the talk of stagflation and energy crisis, I’m worried that we have the story about food wrong too. Not only is the link to energy being seriously overplayed and for bad reasons. But the idea that we are back to 1970s in real terms, may be quite misleading.”

Leave a Reply