Unless you’ve been living in a cave, you might just have noticed that we are in the midst of an increasingly irrational housing price bubble. US house prices adjusted for consumer price inflation for instance are back to the 2006 highs. What might happen next? The obvious temptation is to cry wolf and predict a massive bubble. “I mean these prices are crazy, aren’t they?” well yes they are but 1) if people have no other choice and 2) interest rates are low, helped by 3) pointless/counterproductive (to the countries interest, not partisan interests) government housing policies, then it might all be perfectly rational, despite my protestations.

My own sense is that the only way the party ends is if either a) we massively increase supply (fat chance) or b) sharply increase interest rates (fat chance). What might be more probable is a slow puncturing of prices, but I’ve been predicting that for ages, and I have been consistently wrong to date.

So, given appalling track record, it might be worth reading the views of John Calverley, Tricio’s Chief Economist. He’s written an excellent, sensible two part blog here. I’ve paraphrased his core arguments below but his key point is that we are not likely to have a burst but that “the housing boom is likely to accelerate the Fed and probably the Bank of England to a more hawkish position”.

- It really is different this time – no repeat of 2008. “What is different this time is that we are not seeing the same amount of financial engineering. Mortgage lending is much more controlled as is securitisation. And banks have much stronger capital ratios. This makes a financial crisis unlikely even if house prices fall back at some point. A big fall in prices could however, have quite a big impact on consumer behaviour.

- Expect higher real yields. “At Tricio, we expect the US 10-year government bond yield to head into the 2-3% range over the next year which will push long-term mortgage rates up too…. In the UK the argument for becoming more hawkish is stronger. The Bank of England is expected to turn more hawkish on rates anyway if the economic upswing continues strongly and assuming the Delta variant can be managed without new lockdowns. Frothy housing, if it continues beyond the stamp duty holiday period, gives it another reason for that. Moreover, importantly, the policy rate in the UK is much more directly connected to mortgage rates as most people in the UK finance short-term.”

- Don’t forget the good old 18 year property cycle. “OK, it is not always exactly 18 years but there is plenty of evidence for a house price cycle of around 18 years (call it 15-20), not just in the US but around the world. The original observation of an 18-year price cycle goes back to Homer Hoyt writing in the 1930s. US prices peaked in 1990 and then again in 2006, so 16 years. We are now 15 years on from the 2006 peak which suggests the next one is not too far away.

The bottom line: expect much higher real rates up to a point and a slowdown in the UK property market but probably not until 2022.

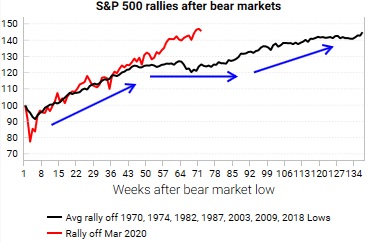

Back in the equity markets, Variant Perception has just published an excellent blog that echoes my own point that markets tend to be recursive and iterative.i.e they move in phases that are in turn built on psychological confidence and can easily relapse. Last week I outlined my own pet theory which is that markets move in a three-step process. First the rebound, then the contemplative sideways phase, and then the final blow-out rally – or pronounced bear push. Variant Perception offers up a similar analysis here.

They argue that a bull market can usually be classified into 3 phases. “Phase 1 is where the “easy” gains occur, there is widespread skepticism towards the equity rally and valuation multiples surge in anticipation of the coming recovery in earnings. We are now in phase 2 of the bull market, where trading conditions become much choppier, and earnings growth merely helps to justify the previous surge in valuations. The difficulty with today’s market is that analysts have revised up earnings estimates much quicker compared to previous post-recession rallies. Only sectors most hurt by Covid are yet to fully price in the recovery. We think there’s more value in stock selection and country/sector rotation in phase 2 of the bull market. Eventually we will enter phase 3 where persistent earnings growth becomes the main driver of equity gains as the economic cycle matures.”

Source: Bloomberg, Macrobond, Variant Perception

I think this analysis is spot on. I expect a nasty wobble imminently but then at some point between Q4 21 and Q2 21 we’ll have the third leg of the rally.

Leave a Reply