I’m not sure if you get the same sensation that we are in a weird perpetual motion machine that can’t stop itself. I have a portfolio of US stocks on the IG share trading platform and every day I check the total value of the portfolio and every day it seems to grind higher – and most of those stocks are fairly boring, mundane growth stocks such as Microsoft or Salesforce. Even some of my low-cost gold producer stocks are still pushing, marginally, ahead.

And then there’s always the slightly bonkers stocks. Take KR1 which I have talked about in my Citywire column many months ago. I suggested that it might be a smart way to access the growing digital currency ecosystem as it invested in all manner of new blockchain businesses. I bought a slug of stock at 15p just for fun. At the end of last week, I looked in amazement as it shot up in price from around 100p to 150p in one day and then fell back to around 115p. Obviously, I dumped some of the shares, though decided to keep about half. I have no real sense of any meaningful way of valuing these stocks, which leaves me happy to keep a chunk but then reinvest in the profits in something really boring like the newly minted Cordiant Digital Infrastructure fund.

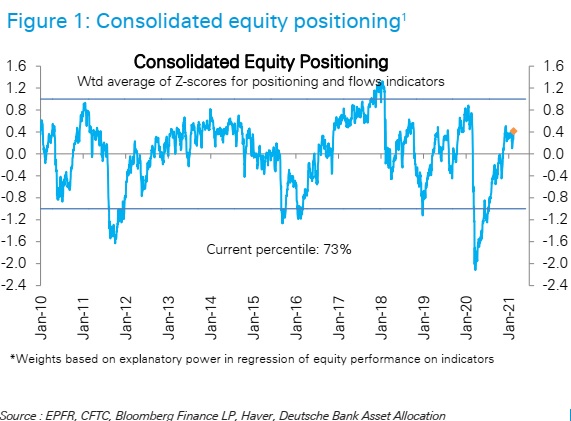

I’d like to say to you that I think a big turn, downwards, is imminent. I still think we are due a proper 5 to 10% correction at some point this year but I would not be terribly confident it will happen any time imminently – by which I mean in the next few weeks or months. Take the chart below which is from the equity analysts team at Deutsche Bank in the US. It pulls together the bank’s various fund flows indicators to build a composite equity positioning index. This measure shows that markets are in enthusiastic territory but nowhere near recent peaks. This bull market could grind higher.

And just in case you thought that bullish sentiment was restricted to US equities, think again. The excellent Tricio Investment Advisors have just released their latest Weekly Talking Points. I was particularly drawn to the chart below from their chief strategist Gerry Celaya.

The chart shows the Italian 10-year bond yield versus its German peer. According to Gerry, “they are showing some really optimistic expectations over Italian debt risk. Italian 10-year bond yields are hitting all-time lows below 0.5% while the spread over the German bund yield is cracking below 100 bps.” Berar in mind 10 years ago that Italian yield was 7.5% and the spread 500 basis points.

That said, I think one can argue that In a negative-yielding world, then 0.5% isn’t bad. Gerry reckons that that spread could even compress below 80 basis points which I think is completely possible, implying that the 10-year bond yield could crash closer to 0.20%.

Gerry rightly in my view concludes that “ this is going into ‘lofty’ investor sentiment territory and is worth watching as another indicator to gauge ‘overdone’ investor optimism. “ Keep watching that Italian 10-year bond yield for hints of market volatility.

I will finish today with one last chart from StoneXs global strategist, the always controversial Vincent Deluard. He has been on something of a mission to deconstruct and critique the rise of ESG investing – the subject of my new Citywire US column. He’s already, correctly in my view, nailed ESG funds as encouraging investors to put money work to work in businesses that employ fewer people and are much bigger in size. His latest data scrape contains a more incendiary claim. His analysis reveals that “there is an almost perfect inverse relation between companies ESG ratings and their effective tax rate. CCC-rated companies pay an average of 27% in taxes, almost twice the rate paid by the virtuous AAA-rated group.”. So, ESG encourages us to invest in businesses that employ fewer people, pay their CEOs more money, are more mega large-cap focussed AND pay less corporate taxes. Ever wonder why the populists get votes?

Leave a Reply