You don’t need to look at Gamestop – and the other sorry candidates – to realize that markets are looking frothy at the moment.

Take the chart below which comes from the latest issue of the excellent Sunday Briefing intelligence publication.

This chart shows firms whose shares have doubled over the past three months and whose price is more than ten times sales.

Enough said.

But it’s not just equities that are also being impacted.

Take commodities.

Arbrook runs a successful US equities fund and in their latest monthly note they observe that

“Corn prices are up almost 80% since their recent low in August 2020. The last time they rose this much in such a short space of time was a decade ago. While wheat and soy have both significantly increased in price over this period too, corn has been the standout”.

In equity terms, Arbrook reckons this benefits one of their portfolio businesses called Corteva which was spun out from the merger of Dow Chemical and DuPont in 2019.

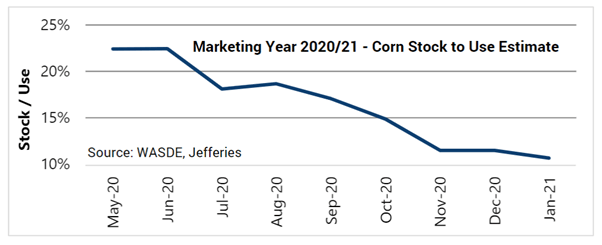

“Corteva is one of the “Big 3” of seed and crop protection alongside Monsanto (now Bayer) and Syngenta (now part of China National Chemical Corporation). Should crop prices sustain at these levels we believe Corteva stands to benefit because of the relatively higher mix of corn in its product portfolio. A measure of the level of demand for a commodity is the Stocks-To-Use Ratio, which for corn has trended down consistently over the last few months (see inset).”

Sticking with the commodities theme, I also noticed a note out this week from commodity analysts at SocGen. Cue scary numbers coming out of the livestock complex.

“In the week to 26 January, the commodity markets saw a large $7.7bn bullish flow, with long building of $6.0bn accounting for most of it. As usual, the precious metals and energy sectors were the main contributors, but the livestock complex was not far behind, which is very unusual. (my emphasis added).

“At $1.6bn, it saw its second-largest bullish flow on our records (going back to 2006) and the largest since 2013. Each commodity in the complex saw relatively large bullish flows, but live cattle stood out the most with $1.2bn worth, almost matching the largest bullish flow on our records in 2012. Prices jumped as the USDA released its cattle and hog slaughter estimates on 22 January. The year-to-date figure for lean hogs is 8.5m heads, down 8.2% yoy, and for live cattle the reading is 2.0m heads, down 9.8% yoy. In addition, the North American Meat Institute suspects that the US government could soon impose COVID-19 safety rules on meat packers.

“It is unclear what such rules would encompass, and they could slow down processing. This comes as the price of corn has been rising for months, affecting the number of cattle on feed, i.e. cattle that aren’t mature enough to be slaughtered. Feeder cattle have a forward-looking price effect on live cattle, as the feeding process takes two to three months, after which the cattle are reclassified as live cattle. Another strong driver is the coming Lunar New Year, the peak demand season for meat in China. This year’s Spring Festival kicked off on 28 January, with the New Year falling on 12 February. China’s population migrates on a large scale to spend time with family, and meat, especially pork, is a staple of celebratory meals. In a normal year, the festive period sees 2.8bn trips, either by car, rail or air. Last year only saw 1.4bn, but officials expect it to increase to 1.7bn in 2021. Another impact of COVID-19 is that following cases of contamination through meat imports, control of overseas shipments has been beefed up. This has resulted in higher domestic prices. January supplies were down 0.4% yoy despite an 11% yoy increase in domestic production, as meat products were slow to reach the market.”

Deflation, what deflation?

And of course, the technology complex of stocks continues to power ahead.

Of particular note is Microsoft, which I own in my US portfolio. I hadn’t clocked their recent numbers properly but Arbrook reports that the software giant reported a 390 basis point increase in their operating margin largely because of a lack of travel and entertainment spending.

Arbrook reckons that “acceptance of the need to digitize the operations and customer interactions of real-world products has rapidly shifted since the pandemic. Microsoft is a key enabler of this with their Azure cloud-based services. They are alongside Amazon Web Services, ANSYS, ServiceNow, and Splunk as being companies that are selling the “picks and shovels” to the digital goldrush.”

Leave a Reply