I’ve been predicting a proper meltup for ages now – even last year I thought we might be due a proper bullish bout on insanity. Well, we seem to be on the receiving end of one as I speak. My portfolio of US stocks – mostly though not exclusively tech ones – seems to spend every day grinding higher, inexplicably in my view.

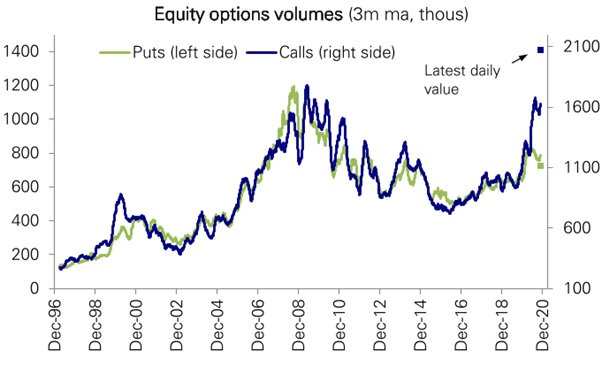

Or perhaps I’m not looking at all the obvious signs. Deutsche Bank’s US analysts argue this week that we are not far off peak equity bullish levels, powered in part by those dastardly private investors and their love of options. According to the Deutsche analysts “Bullish equity option buying has been rising sharply again over the last 3 weeks and is at its highest level since early September. As call volumes continue to surge, put/call volume ratios (15th percentile) have plunged to extreme lows, driven entirely by single stock equity options (2nd percentile) which fell to their lowest since 2010 and back to Tech bubble levels, while index put/call ratios (60th percentile) remain relatively elevated. Rising bullish option buying has meant implied vol has remained high this week, despite the continued market rally and falling realized vol. Vol premiums have risen to the top of their historical band for the S&P 500, and well above for the Nasdaq 100. “

But this peak enthusiasm isn’t only evident in equity markets. Markets that price risk are also showing signs of euphoria. Take the market for bank credit default swaps, which insure you against a big systemic bank default. Pricing on these relatively liquid markets is driven by all manner of factors but one key message is that pricing, especially for one-year swaps, has collapsed perhaps indicating that investors are growing less worried about a wave of defaults. I track these markets for a regular monthly markets update for the UK Structured Products Association (UKSPA) and according to data they use most of the big European based banks saw very substantial declines in pricing especially for 1-year swaps – US banks, by contrast, saw a more gentle decline in prices. Only one bank bucked the trend, at the margins – HSBC saw the pricing for its 1-year swaps increase very marginally (from a low level) while its 5-year swaps fell back in line with its European peers.

That said two banks stood out for this observer – the first is that UBS saw a decline in pricing for its 1-year swaps in the last month from an already low 9.5 to 6.22 basis points. The most striking number though was for Lloyds Bank. Its one-year swaps are now priced at less than those for HSBC – at 9.73 bps – while its five-year swaps also trade below those for HSBC (23.6 vs 31.46). That’s a remarkable testament to Lloyds’ transformation.

In the first table below, I have listed pricing at the beginning of December. In the second table, by comparison, I have listed pricing from back in April. What a difference a few months make!

| December | ||||||

| Bank | One Year | Five Year | Credit Rating (S&P) | Credit Rating (Moody’s) | Credit Rating (Fitch) | |

| Santander | 8.49 | 31.06 | A | A2 | A- | |

| Barclays | 16.94 | 49.58 | BBB | Baa3 | A | |

| BNP Parabis | 9.93 | 29.65 | A+ | Aa3 | A+ | |

| Citigroup | 30.47 | 50.34 | BBB+ | A3 | A | |

| Commerzbank | NA | NA | A- | A1 | BBB+ | |

| Credit Suisse | 11.25 | 41.11 | BBB+ | Baa2 | A- | |

| Deutsche Bank | 40.11 | 101 | BBB+ | A3 | BBB | |

| Goldman Sachs | 30.79 | 52.23 | BBB+ | A3 | A | |

| HSBC | 10.97 | 31.46 | AA- | Aa3 | A+ | |

| Investec | n/a | n/a | N/A | A1 | BBB+ | |

| JP Morgan | 24.36 | 41.41 | A- | A2 | AA- | |

| Lloyds Banking Group | 9.73 | 31.15 | BBB+ | A3 | A+ | |

| Morgan Stanley | 27.17 | 46.6 | BBB+ | A3 | A | |

| Natixis | 34.08 | 46.43 | A+ | A1 | A+ | |

| Nomura | 40.85 | 95.11 | BBB+ | Baa1 | A- | |

| RBC | 19.11 | 56.52 | AA- | Aa3 | AA- | |

| Soc Gen | 10.68 | 31.46 | A | A1 | A | |

| UBS | 6.22 | 23.6 | A- | Aa3 | A+ | |

| Table for April 2020 | |||||

| Bank | One Year | Five Year | Credit Rating (S&P) | Credit Rating (Moody’s) | Credit Rating (Fitch) |

| Banco Santander | 18.4 | 41.87 | A | A2 | A- |

| Barclays | 46 | 95 | BBB | Baa3 | A |

| BNP Parabis | 23 | 55 | A+ | Aa3 | A+ |

| Citigroup | 58 | 82 | BBB+ | A3 | A |

| Commerzbank | NA | NA | A- | A1 | BBB+ |

| Credit Suisse | 46 | 95 | BBB+ | Baa2 | A- |

| Deutsche Bank | 199 | 228 | BBB+ | A3 | BBB |

| Goldman Sachs | 58 | 85 | BBB+ | A3 | A |

| HSBC | 51 | 22 | AA- | Aa3 | A+ |

| Investec | n/a | n/a | N/A | A1 | BBB+ |

| JP Morgan | 39 | 61 | A- | A2 | AA- |

| Lloyds Banking Group | 20 | 46 | BBB+ | A3 | A+ |

| Morgan Stanley | 54 | 81 | BBB+ | A3 | A |

| Natixis | 34 | 46 | A+ | A1 | A+ |

| Nomura | 40 | 95 | BBB+ | Baa1 | A- |

| RBC | 23 | 69 | AA- | Aa3 | AA- |

| Soc Gen | 24 | 57 | A | A1 | A |

| UBS | 23 | 50 | A- | Aa3 | A+ |

But maybe we are near peak meltup??

There’s a whole bunch of reasons why investors are enthusiastically bullish. Many of which I share. Top of that list after a recovery from the virus in 2021 is the ever-present wall of central bank money, which shows no signs of vanishing any time soon. In fact, the US monetary response to the current crisis has been at least five-times bigger in size than the actions taken after the 2008/09 GFC, and, according to Cross Border capital’s research, it is being led by retail, not wholesale money growth, i.e. cash that can and will be spent by the public.

But we can all too easily get carried away with ourselves and I sense we might be nearing that point. Cross Border has certainly grown more cautious, reminding investors of the stark warning from history which is that “… strong economies do not have strong financial markets.” In other words, Cross Border reminds us, that if money is being spent in the (virtual) high street, it is not being invested in stocks. Their bullishness about economies forces us to become bearish about stocks.

“The best time to invest in equities is when an aggressive Central Bank is trying to stimulate a sluggish economy. This has been the story of 2020. But.. the economic picture may already be changing. As the old hedge fund saying goes, when the news-flow shifts from ‘awful’ to just ‘plain bad’ they make most of their money. It surely follows that the most dangerous time for losing money in stock markets is when the news-flow moves from ‘excellent’ to just ‘good’.”

“If we are forced to time the up-coming cycle swings, we should think about rotation into potential ‘catch-up’ stories for Q1 2021, such as gold, Emerging Markets, and UK stocks, but we expect to more seriously exit our investments during Q2 and Q3, before possibly returning in Q4, once investor sentiment has cooled once again.”

Sounds eminently sensible to me though even Cross Border accepts that there is a key unknown – how aggressively China will act in 2021. “ The Chinese economy has been ignored by market commentators for some time. This may be partly because it has lately flat-lined and partly because the People’s Bank (PBoC) has visibly been tightening monetary policy through much of 2020 by letting the Chinese monetary base shrink. However, things are also changing here and not least the revival of the once rapacious Chinese shadow banks”.

If China was to start turning on the taps, this current melt-up might last a good deal longer.

Leave a Reply