Volatile market conditions, both upwards and downwards in direction, present real opportunities for certain types of investor. In theory hedge funds (and by default absolute returns managers) should benefit, although in truth only a small fraction do actually produce above average returns. I would argue that this failure to produce discernible alpha is largely because trying to second guess the market or macro is a fool’s errand most of the time – and damned difficult to achieve. A talented few can pull it off some (or most) of the time but they are vanishingly rare and usually based around specialist knowledge of niches or superior research (or analytical) fire power.

Another group of investors who also tend to benefit from uncertain markets are those who put money to work in structured products. This is a very different segment of the market, offering investors returns which are largely predefined by contract or, to put it another way, they can offer ‘alpha by contract’, without all the bluff, bluster and vagaries of active fund management or hedge fund management.

Why might structured products benefit from current market conditions? Many products are built around a number of underlying component parts, including options-based contracts, using puts and calls. And these can shoot up in value during high volatility markets i.e the vol component of options increases.

If you were looking at investing in a capital protected structure, which removes market risk, then this volatility will be hurting the terms you can find on offer right now. But if you’re prepared to look at capital at risk structures for part of your portfolio then these products, which are usually designed to reduce the level of market risk significantly (such as allowing the market to fall by, say, 40% before reducing capital repayment) without removing it completely, then short term market volatility can really boost the returns you can access at times like the present. And of course we haven’t been short on market volatility of late! .

Now, of course, the material benefits of investing by contract through structured products come with credit risk, in other words the counterparty bank issuing the contracts needs tostay solvent through the investment term. But if you believe that the counterparty bank won’t default, not least as governments and central banks around the world are busy demonstrating ‘whatever it takes’ levels of support for their financial systems, and therefore banks, currently, and if your product provider / plan manager is capable, agile and thinking hard about ways in which to offer investor value in the current environment, then you should be able to make use of the elevated market conditions to access improved product terms right now, including either juiced up potential returns or lower risks to capital and more defensive strategies for generating positive returns .

We can see this clearly in a new suite of products, for example, coming out this week from Tempo Structured Products, led by Chris Taylor, an industry veteran. For the record, I know and have worked with Chris on a few projects, so I’m not an entirely disinterested observer.

The big headline here is that Tempo’s product development response to the current market environment is a combination of structures which now have a 30% end of term barrier, which means that the underlying index would have to fall by more than 70% before the capital is at risk at the end of the plan, with deeply defensive options for investors, and exceptional terms to boot!

Such an end of term barrier level is a substantially lower than most index barriers I’ve seen and a clear demonstration of how these products can be constructed in the current market conditions.

Important to note here that the benchmark index is a variation of the FTSE 100 ,called the FTSE 100 FDEW (fixed dividend equal weight) which is an equal weight, total return (including all dividends) and fixed dividend deduction version of the blue chip UK index. This needs to be understood, but Tempo’s plan literature is very clear and explanatory.

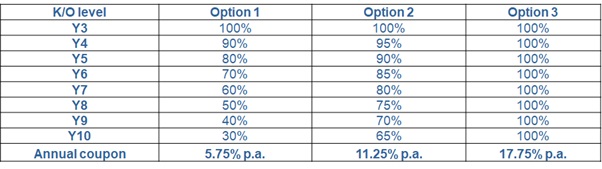

There are three products open. Perhaps the most mainstream product is the Long Kick-Out Plan, which pays out an annual return of between 5.75% on option 1(which allows the index to decline by a whopping 70%), to 11.75% on option 2 (which allows the index to decline by 35%), to 17.75% on option 3 (which requires the index level to be above start level at some point in the next decade).

I also think the Long Growth Kick-Out Plan also looks interesting, which has the potential to deliver a 125% coupon at year 5, equivalent to 25% per year, if the index is simply 5% higher in 5 years, i.e if it rises by just 1% per year.

The plan also offers a second strategy, as part of a 2-in-1 approach for investors, offering five times the index level, above 80% of its start level, at year 10, with a maximum potential return of 150%, which is the equivalent of a 15% per annum return (which also simply requires the underlying index to only advanced by 1% a year, for the next ten years).

The Tempo Long Kick Out Plan

But perhaps my favourite product is their Long Income Plan. Tempo have been quietly building up this idea for a while now, finessing the features of the plan . Structures like these now represent what I think is a great alternative to cash at today’s even more painfully low rates, fixed income bonds at their similarly painfully low yields (perhaps an asset class which is now best thought of as offering investors ‘return free risk’!), and classic equity income funds or hybrid funds that invest in say convertibles.

In effect you get something that looks and feels a bit like a bond, but its quarterly income is dependent on the benchmark index not being breached at the end of the term. The first option has the barrier set at 30% of the index start level (in other words the index can fall by up to 70%) and pays 4.25% per annum, while the second option pays out 7.15% per annum if the index is above 75% of the start level (in other words, it can fall by up to 25%).

It’s also worth mentioning what Tempo call a ‘memory feature’. Should the index ever be below the levels needed for a quarterly income payment, the plan remembers any missed payments and can make them up at any point in the future, if the index has recovered. So, if you believe the index will be above either 30% of today’s level in a decade, for option 1, or above 75% of today’s level for option 2, you can expect the plan to pay every coupon. This product also has a kick out feature set at 110% of the start level from the 3rd anniversary.

The Tempo Long Income Plan:

The start date for the Long Kick-Out Plan and Long Growth Accelerator Plan is 19 June, and for the Long Income Plan its 26 June. But if you are interested in the plans, look into them sooner rather than later in the offer periods, especially if markets carry on rising as they are !

Leave a Reply