I tend to refrain from joining many of the increasingly vitriolic viral debates online, largely because I cannot claim any expertise. That said I think Tyler Cowan at the Marginal Revolution blog and Johnathan Kay at Quillette are both doing a fantastic job at sharing truly original insights. For the latter, his latest article on super spreader events is truly excellent – read it here: https://quillette.com/2020/04/23/covid-19-superspreader-events-in-28-countries-critical-patterns-and-lessons/

That said I cannot quite refrain from making some wider observations with relevance to investors.

So, in no particular order I would offer the following thoughts on the virus based debates:

- The weakest link is the problem. There’s a big debate going on between those – in the majority – who think we should trace, test and then quarantine before ending the measures, and the smaller minority who think we should slowly build up herd immunity (call it the Swedish argument). I can’t offer any fresh insight about this debate but if this article in the Times Of India is right and some in the developing world are thinking of adopting the herd argument – article is here https://m.timesofindia.com/india/covid-19-a-herd-immunity-strategy-could-actually-work-in-youthful-india/articleshow/75287811.cms – then we may have no other choice than to go down the herd route. That’s simply because all our national public health systems are only as strong as the ‘weakest’ national link and if a major country which ships people back and forth decides to go down the herd route, then new cases will simply keep emerging via in-migration and travel. Of course, we could all simply shut our borders but I’m not sure that’s a terrifically good idea unless you are New Zealand.

- One of the logical implications of the Test, trace and quarantine route is that when you find someone who has the virus you need to properly quarantine them away form their families (especially if they have young kids or young adults). That means forcing them to go to central quarantine facilities and making them stay there. Personally, I think there is zero chance of that happening in the UK and the US. We would face open revolt. Without truly effective quarantine, all test and trace strategies will ultimately fail.

- The whole herd immunity vs test, track and quarantine argument is rapidly descending into the culture wars with many on the left saying how heartless the herd strategy is while the Right accuse the testing brigade of sitting on their hands while the economy implodes. As Phillip Collins in The Times today eloquently reminds us we have always made ruthless, rational calculations about the value of a life and this time will be no different. But the wider point is that forcing this debate into the culture wars arena is terrible news because it turns participants into keyboard warriors. What we need is hard evidence, real time data and a distinct lack of ideology – the virus, after all, doesn’t care about what we think.

- I am now utterly convinced that those who say we’ll all be video conferencing instead of working out of an office when this finishes (?), are bullshitting at an epic scale. My lasting impression is that for any business hierarchy, home working and home conferencing is a virtual disaster of epic proportions. I simply cannot listen carefully and miss all the visual queues that are so necessary in a business or profession. The minute this crisis winds down, my guess is that we will be racing to dump Zoom and head back into the office (some of the time, I grant, not all). And there is a deeper truth. In any organisation there is always a long tail of folks who are, to be brutally honest, slackers. They do not need any excuse not to commit mindfully to the task at hand. This crisis has given these folks an enormous excuse to avoid any meaningful work. And endless audio calls just make the problem worse. I suspect that there has more than a tiny minority who are secretly enjoying this crisis, assuming they avoid the virus. When it starts to taper off, I suspect they will be deeply unhappy because they might be forced to work much harder over the summer.

Back to investing.

A few interesting insights worth sharing.

First, online music is doing well. Apparently last week Universal Music saw its recorded music revenues grow 13.1% (at constant currency) in the three months to the end of March 2020, with streaming recorded music revenues hitting $1bn in the quarter (16.5% increase yoy). This is similar to the experience of Apple Music who recently showed their subscriber figures rose 13.3% in the second half of 2019. We also learned last week that in the first week in April, streams in the US are up 19% compared to the same period last year. I’d observe that Spotify’s share price has been in the doldrums for weeks now. I think it might be looking decent value.

Next up European equity analysts at Morgan Stanley have this week released a fascinating report on the continent’s airlines sector. I have two on my contrarian watchlist already – Easyjet and Ryanair but I’m adding Wizz Air to that list. The report is entitled “the long runway to recovery” and its key insight is that the industry probably won’t get back to 2019 levels until 2022 although changes in consumer behaviour could delay this target. That forces investors to look at liquidity.

“With airlines’ fleet in Europe close to full grounding in April and May and global capacity according to IATA down c80% yoy in the period, investor focus has been on airlines with the most robust balance sheets and liquidity to fund a full grounding for longer. Airlines have so far succeeded in increasing liquidity by negotiating longer payment terms with governments and suppliers, enrolling in government payroll assistance programs and tapping credit markets. In terms of liquidity, we estimate Air France-KLM and Lufthansa have the more pressing need (having to access further liquidity sources in 3Q), while easyJet has until year end and Ryanair and Wizz have more than 12 months, on our numbers”.

One theme that keeps cropping up in discussions with funds is that wholesale power prices have started consistently falling. I’m sure there’s a cocktail of factors at work here, possibly including the plunging oil price. There’s also the obvious change in work patterns but its interesting to note this week that one of the big renewable’s funds listed in the UK has reported the following.

“On a blended basis, wholesale power prices forecasts have reduced on average by 17% over the next five years (25% reduction over 2020 and 2021) and by 5% from 2025 until 2050. In the GB market, this equates to an average cannibalised capture price of c£39/MWh between 2020-24 and £46/MWh for 2025-50 (in real terms).”

Returning to my frequent observations on the impact of the virus on emerging markets. Renaissance Capital observe that “Ghana’s and Nigeria’s interest payments are fivefold and threefold, respectively, their healthcare spending. Kenya’s spending on interest payments is twice its healthcare spending.”. Clearly debt forbearance needs to be top of the agenda at the G20.

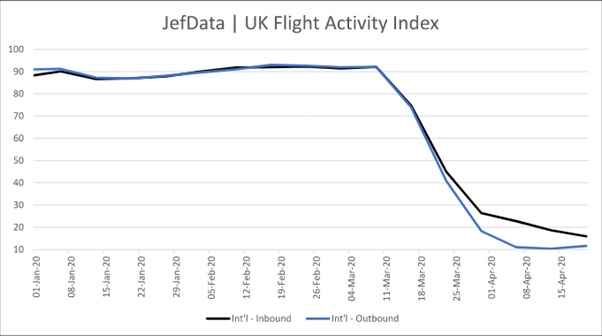

Last but by no means least Jefferies are publishing a new data series called EAR which looks at near real time alternative data sources to track any hint of a rebound in the real economy. They reckon their proprietary system will be really useful when the government starts to wind down its restrictions.

Using this week’s figures Energy consumption is down -22% vs. January (-20% last week), UK public transportation is unchanged at -78% vs. pre-COVID levels, and traffic congestion has started to pick up with the latest reading at -39%. Flight activity remains depressed at -84% (-77%), but hiring trends are starting to improve at -77% (from -87% last week). By contrast, China public transport activity improved to 66% of pre-COVID levels, from 57% last week. Traffic congestion in major Chinese cities is now back to normal and Energy (coal) consumption is recovering (84% from 82%)..

The two charts below add a bit more colour to these observations.

Leave a Reply