I was busily WhatsApp-ing yesterday with a few friends around the world and had this back from an old India based friend….which I think horribly sums up my fears….lets hope that none of this pans out….

“The developing world – what can you say? No testing, not enough hospital beds or resources. I saw something on the news last night saying 14k ventilators across the whole of India – let’s be optimistic and say 1% of the population get coronavirus – mmmm – how’s that going to work? And a test here costs 4500 INR – who will be able to afford that? And more immediately..News has gradually been coming out here about a Muslim prayer meeting in Delhi that started on 13th March. 3400 attendees some (1000) of whom were in attendance on Sunday. Despite the lockdown and mandate of no gatherings exceeding 5 being in place. Lots of people being traced around the country who attended and many positive and some dead. So I’d say that’s India screwed and I’m expecting that once numbers increase there will be unrest with people turning on Muslims”.

In the spirit of wanting to share some of the grim tidings more widely amongst different nations, I was also struck by this short note yesterday from Charles Robertson, Global Chief Economist at Renaissance Capital.

His surprise headline of the weekend was that Turkey on 29 March had over 9,000 cases and that “we are going to see tens of thousands here very quickly. President Erdogan still resisting formal lockdown. “. The table below projects what could happen. Next step? All those refugee camps and living hells in Syria. Let’s hope not and with a fair wind, the world might rally around and start helping out these developing countries. Time for proper multilateral action, not nationalist, populist gesture politics.

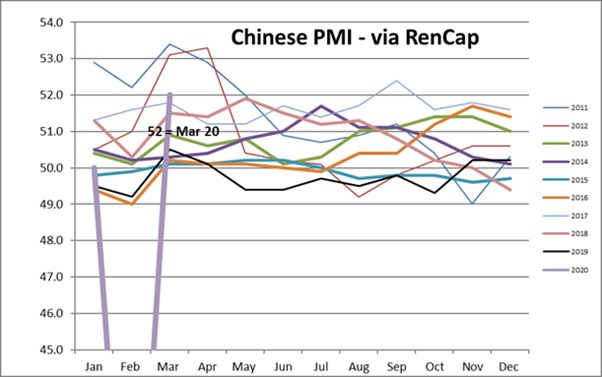

Sticking with Charlie at Renaissance, he’s also highlighting the fact that China has managed to ‘stop’ the virus with just 3,309 deaths – the Chinese “also appear to have done it with just a one-month shutdown of the economy.” Crucially we’ve just seen China’s PMI numbers rebound in the biggest rise ever, admittedly from a low base. As I have said many times before, investors need to think long and hard about how they re-orientated their portfolios to boost Asia allocations.

That said much of this Chinese triumphalism leaves a very sour taste in my mouth – I’m not sure we could ever even remotely copy their playbook….nor should we…

Sticking with the positive vibes, I see Mark Asquith, Lead Manager of the Somerset EM Discovery Fund, reckons we are facing a ‘once in a lifetime opportunity’ for EM equities.

Here’s his take and to be fair he’s one of the best managers in this space, then again he would, of course, say this…

“History has shown us that supernormal returns can be made during this type of environment. Before the Coronavirus hit, EM small and mid-caps were already trading on historically attractive valuations. So far this year EM smaller companies have fallen more than 30% in USD terms and markets like Brazil are down around 50%. Market dislocations of this magnitude happen rarely, perhaps once or twice in a generation, and have historically provided excellent entry points for investors.

“The last down market of similar severity occurred during the financial crisis of 2008/9. From the lows of November 2008, EM small caps rose more than 150% is USD terms in a little over 12 months. Brazilian small caps rose around 300% over the same period and almost 500% within two years. No two bull or bear market is the same, but we could see similar moves from current levels over the next few years.

“Given the continued uncertainty, it is clearly not out of the question for markets to sell off further from here but even accounting for this, on any reasonable time horizon we still see this as a very attractive entry point. Our team is currently fielding an unprecedented amount of buy recommendations from the analysts. At the same time, we believe almost every stock within the current portfolio deserves additional capital – the challenge is picking the best place to invest.”

I’m not quite as enthusiastic or breathless as this. My suspicion is that Emerging Markets will take a very nasty hit in the next three to six months and that if you do want exposure, you need to think about more focused AsiaPac exc Japan exposure.

Leave a Reply