First off, an event reminder. On June 12th I’m running with ETF Stream a morning only event on tech investing with headline speaker the excellent Ben Rogoff from Polar capital plus a star-studded array of active and passive fund managers. Tickets are free but running out fast – go to https://www.etfstream.com/event/big-call-technology-funds/

Next up I’m also really excited to be running an event aimed at alternative income investors, especially in the fund’s world with AltFi. Our aim is to get a big crowd of specialist altincome managers in the room on the morning of June 19th, also in the City of London. If you want to attend or run a fund in this space drop a line to dan@altfi.com straight away.

Moving away from events, let’s consider energy equities for one moment. I think we are fast approaching an interesting turning point. I take very seriously the need for a radical decarbonization agenda which I don’t think is an elitist agenda designed to stuff the ordinary working person. There really is a big positive shift underway which over the long term will benefit us all, with more jobs and a better environment. Equally, though I’m not convinced oil stock disinvestment is a good idea but I do think that there is a growing background perception that oil equities are much riskier than the vast majority of stocks. Of course, they are seen as cyclical but I also sense that in the back of many investors minds, there is that growing, nagging worry that all those valuable oil assets might become increasingly devalued over time. As I’ve already mentioned in my FT column, this concern is being forcefully articulated by some large institutions and I think it is having a corrosive effect on long term investor perceptions? How so? One very concrete way is that I think traditionally when a sector presents itself as cheap, most investors focus purely on hope for future share price appreciation. They also focus on balance sheet drivers for future dividend growth.

There is now growing evidence that energy equities are cheap. But my worry is that despite these hard numbers, many marginal investors are staying away – concerned about the decarbonization agenda in Europe at least. Evidence for the assertion about value comes in a Morgan Stanley paper out today from the team led by Mathew Gorman and Graham Secker. Here’s the papers executive summary:

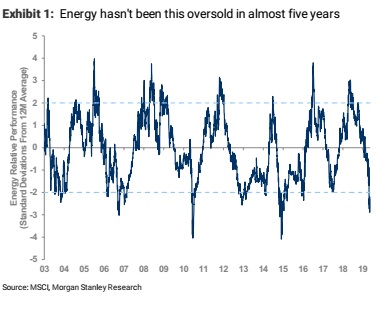

- “Energy looks very oversold, especially relative to oil prices. The sector recently traded close to 3 standard deviations oversold. Despite a $20 bounce in the oil price in recent months, the sector has fallen to a 13-month relative low.

- Relative valuations of the Energy sector are fairly low… The sector trades 10% cheap to historic averages on a range of relative valuation metrics, and the sector’s relative FCF yield is close to an all-time high.

- … and the sector’s high and secure dividend yield looks particularly attractive. Given the combination of a moderating risk-reward for European equities, low bond yields and extreme valuations of Quality, we favour owning stocks that offer a high and secure dividend yield. Energy has the third highest yield out of 24 industry groups and offers a yield 1.5x the market vs a historical average of 1.3x. The last time FCF coverage of dividends was this high, the sector traded in-line with the market yield. We highlight that there are an abundance of stocks with high and covered dividends at this time.

- Energy has lagged strength in earnings momentum. In recent months, the sector has underperformed in a rare divergence from strength in relative EPS trends. While Value vs Growth earnings revisions have reached historic lows, Energy is one of only two predominantly Value industry groups seeing earnings upgrades.

- The macro environment should be supportive of Energy outperformance. Our Cross-Asset Team’s US Cycle Indicator has just moved into “Downturn” territory, after which Energy has historically been the best performing European sector. Our FX team’s USD bearish view should also favour Energy”.

The two charts below nicely sum up both the valuation and relative underperformance of the shares in the sector.

Now I think it important to say that the MS strategists aren’t raving bulls and in fact remain neutral on the sector. I also think that energy stocks could get even cheaper – especially if my decarbonization theory really does seem to undermine long term confidence in the sector. But we also need to factor back in geopolitics. I’ve been heartened to hear that Trump is now spinning the story that he doesn’t want war with Iran – thank Christ for that. Hopefully, he will put Bolton back in his box, or even better get rid of the man. But Trump and his advisers have already boxed in the Iranian’s and I am still extremely worried that Trump doesn’t control his ‘allies’ and especially those in the Gulf who might be willing to push America into a more dangerous scenario. I remain extremely concerned that we could get a geopolitical blow up in Gulf with an immediate impact on the oil price. That could be positive news for oil stocks – and bad news for everyone else. In fact, I’d go so far as to say that the chances of $100 oil have risen from under 10% to over 30% in my view. Unlikely but more than possible.

Paradoxically I also think if that did happen it would be the final nail in the coffin for hydrocarbons. At that point, even some climate skeptics might accept that transitioning away from notoriously volatile hydrocarbons might be a smart economic move – short term economic pain but long term gain. Equally, in share price terms, it would be fantastic news for oil equity prices but terrible news over the long term as the hydrocarbon divestment movement grows in strength.

On a side note, MS list their five favorite stocks, most of which are no great surprise (BP, Total) but I am interested to see Hurricane Energy in there. One to watch.

Leave a Reply