Why so many “savers” ignore interest rates

Quite rightly quantitative easing and the “lower rates, longer” financial model is subject to intense debate, with many pointing out that it has resulted in inflated asset prices. But critics of QE also deploy many other, less effective, arguments, the most specious of which is that it is a tool primarily designed to repress savers – and thus cause moral injury to our wealth. I don’t dispute that there are many (older) savers and investors who are dependent on their cash savings, although I wonder what planet they must be living on. My objection to this latter argument though is that we should really only worry about repression if the vast majority of the supposed victims honestly believe that it is causing them injury. A metaphor here is the rise of CCTV in public places in the UK. Like all good liberals, I worry about this, but the truth is that the vast majority of people subject to this surveillance tyranny really don’t care. More than that – they actually quite like the idea that someone is watching. One man’s/woman’s repression is another’s public safety.

Back in the world of the ravaged cash saver, we face a similar paradox. In my humble experience cash serves many purposes, probably the least of which is as a source of income. Take the example of corporate cash balances – a huge part of the cash equation. There are many reasons why companies hoard cash, with a safety reserve being the primary driver. In my own company, I accumulate cash to make tax payments (financial planning) and to make sure I have a reserve to protect against the worst ravages of the economy. I recently went through the exercise of trying to find a more rewarding home for the cash, to increase my interest rate returns from the next to zero currently paid. The options are beginning to increase and if you are willing to work hard you can possibly earn between 1.5 and 3% now. Hardly a king’s ransom for sure but not something to sneeze at.

And yet I didn’t take the plunge because frankly, I wanted the flexibility to hold cash. That flexibility has enormous marginal benefit, not all of which can be captured using conventional econometric models. Lurking in behavioral finance are, I think, the real reasons why so many of us are willing to sit tight in zero yield cash accounts. Which points to an essential learning from Keynes and his animal spirits. The more volatility we embed within the system at the macroeconomic level, the greater the caution of economic actors – and the bigger the stockpiles of cash. Less volatility and more certainty in the outcome, the less need for reserves.

My hunch is that at a global level, the accumulated mountain of cash that is primarily motivated by these defensive urges (and obvious day to day financial planning requirements) is many times greater than the stash of cash primarily designed to produce a living income.

If this is the case, then so-called financial repression is limited in scale and shouldn’t overly bother central bankers. What should concern them is to create a stable macro-economic framework which reduces the amplitude of business cycles.

More fund portfolios for 2019

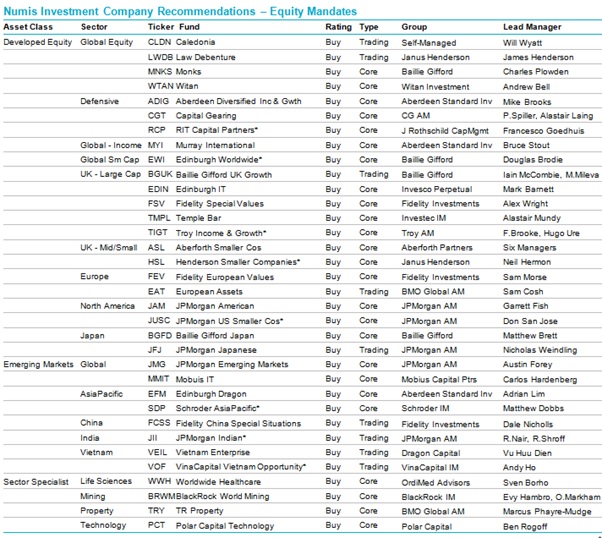

Sticking with the new year rash of portfolio ideas and updates, I thought I’d share with readers the latest fund portfolios from Numis and Canaccord, both first-rate funds’ research houses. Let’s start with Numis. Their long portfolio list is below but they have made three changes this quarter:

“adding European Assets as a Trading Buy in place of JPMorgan Euro SmCos, as we see the potential entry to the FTSE All Share Index as a catalyst for a rerating during 2019. We have also added Mobius IT as a Core Buy reflecting the fund’s differentiated global emerging markets mandate. Among the Equity ICs that offer value at present, we would highlight Caledonia (19% discount) and Law Debenture (12%).”

I’m not so convinced by the Mobius It but I do agree that Caledonia is beginning to look really quite interesting for more defensive investors.

Over at Canaccord, Alan Brierley and Ben Newell have updated their flexible Model Portfolio – as well as their relatively new income portfolio. The NAV return for the portfolio was 1.7% last year “although some pressure on discounts in Q4 resulted in a shareholder total return of -0.7%. This compared favorably with FTSE All Share and FTSE Investment Companies total returns of -9.5% and -3.4% respectively.” Over the last 11 years, at an annualized level Nav and shareholder total returns are at 11.2% compared to 4.8% and 6.6% achieved by the FTSE All Share and FTSE Investment Companies indices. At the portfolio level, there don’t seem to have been many changes although there was fund dumped last year – the Highbridge Multi-Strategy Fund.

Back in November the team also introduced an Income portfolio designed to provide an “attractive, progressive and sustainable dividend from a diversified portfolio of investment companies” with a current average yield is 5.4%. In the few short weeks, the portfolio has been around, the shareholder total return was 1.8% vs. -2.1% for the FTSE All Share.

Leave a Reply